Reform backs cryptocurrency tax cut as party receives first Bitcoin donations

Party chairman Zia Yusuf suggested the cut could generate up to £1 billion for the Treasury over a decade.

Reform UK has pledged to cut taxes on cryptocurrencies and set up a “Bitcoin reserve” if elected.

Party chairman Zia Yusuf told reporters on Friday that a Reform government would reduce capital gains tax on assets such as Bitcoin to 10% as part of a raft of reforms to how cryptocurrencies are governed.

Mr Yusuf, who does not own cryptocurrency, suggested the cut could generate up to £1 billion for the Treasury over a decade, saying it would encourage more use of such currency and encourage people to move their assets to the UK.

Cryptocurrencies currently incur capital gains tax of either 18% or 24%, depending on the rate of income tax paid by the person selling the assets.

Mr Yusuf also announced that Reform would allow people to pay tax in Bitcoin and establish a “Bitcoin reserve fund” to “diversify” the UK’s reserve holdings.

He said the UK was “losing ground” to other countries, and added that Reform’s proposals would help the financial services sector “catapult itself back into being a leader”.

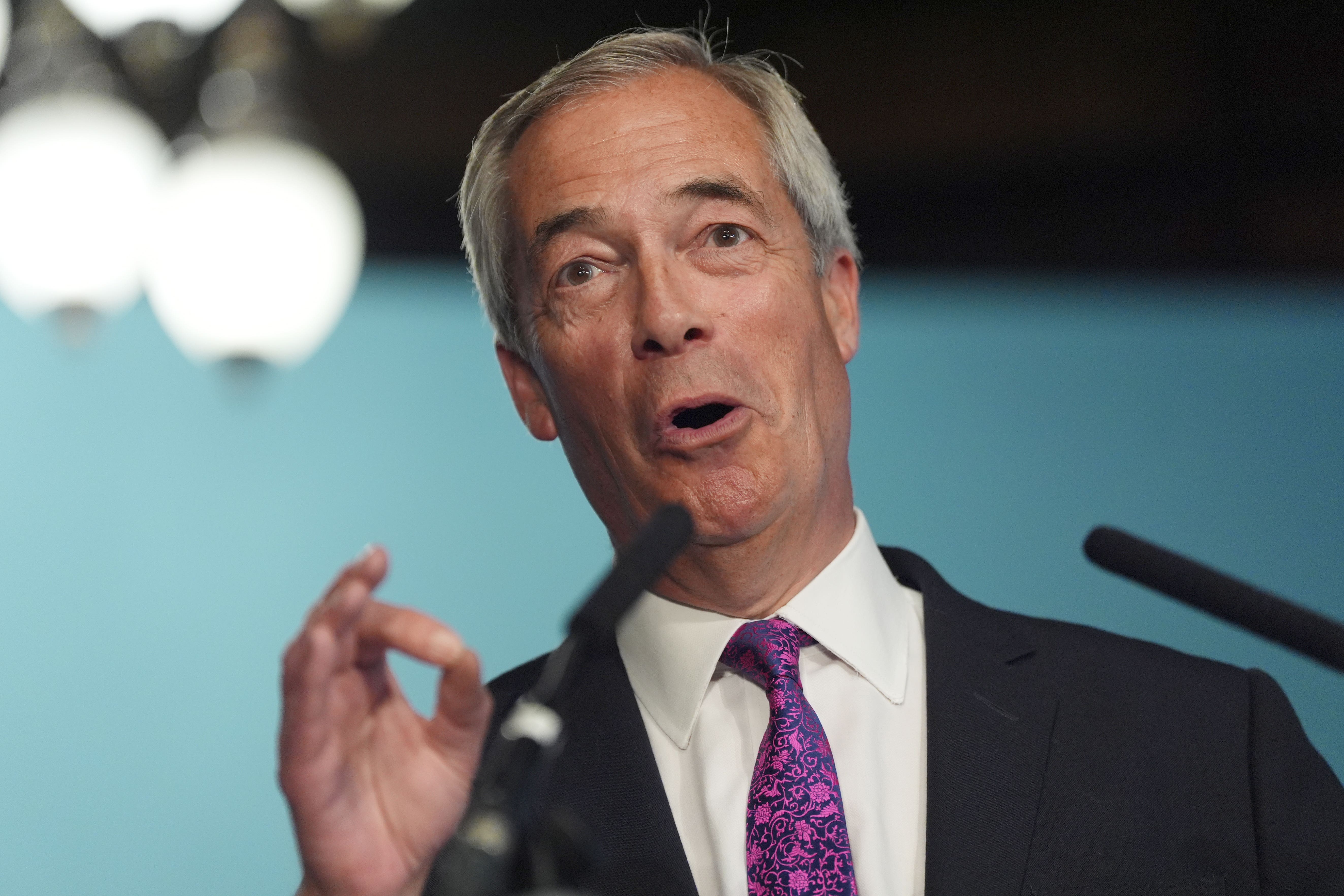

The announcement came as party leader Nigel Farage said Reform would begin accepting donations in cryptocurrency.

Speaking at the Bitcoin Conference in Las Vegas on Thursday, Mr Farage said: “My message to the British public, my message particularly to young people, is help us to help you bring our country properly into the 21st century.

“Let’s recognise that crypto, Bitcoin, digital assets, are here to stay.”

Mr Farage pledged that his party would “launch in Britain a crypto revolution” and make London “one of the major trading centres of the world”.

On Friday, Mr Yusuf told reporters Reform had already received its first cryptocurrency donations, adding they were all compliant with Electoral Commission rules.

Cryptocurrencies such as Bitcoin have increased in popularity in recent years, with research suggesting around 12% of adults in the UK own or have owned cryptoassets, up from 4% in 2021.

Last month, Chancellor Rachel Reeves announced plans to regulate cryptoassets in a bid to make the UK a “world leader”.

She told a conference that she would “back the builders” as she announced plans to make crypto firms subject to regulation in the same way as traditional finance companies.