‘High tax could mean higher rates of happiness, which is why I’m happy to pay more’

The fuss being made about 0.3 per cent of millionaires leaving the country if a wealth tax was introduced, while we’re facing the reality of 30 per cent of doctors considering leaving in the next year, makes no sense to millionaire Stephen Kinsella. And there are hundreds of earners like him who are proud to pay and here to stay...

No one can deny the pressure Rachel Reeves is under. In the past few days, the government has committed to a major boost in defence funding, pledged to reinstate the winter fuel allowance to millions of pensioners this winter, and is being asked to abolish the two-child benefit cap. Then there is social housing to fund, education to support and money needed for the NHS and the UK’s growing need for social care.

But how will this all be funded if, as Reeves has indicated, there are no plans to raise taxes to back Labour’s spending plans?

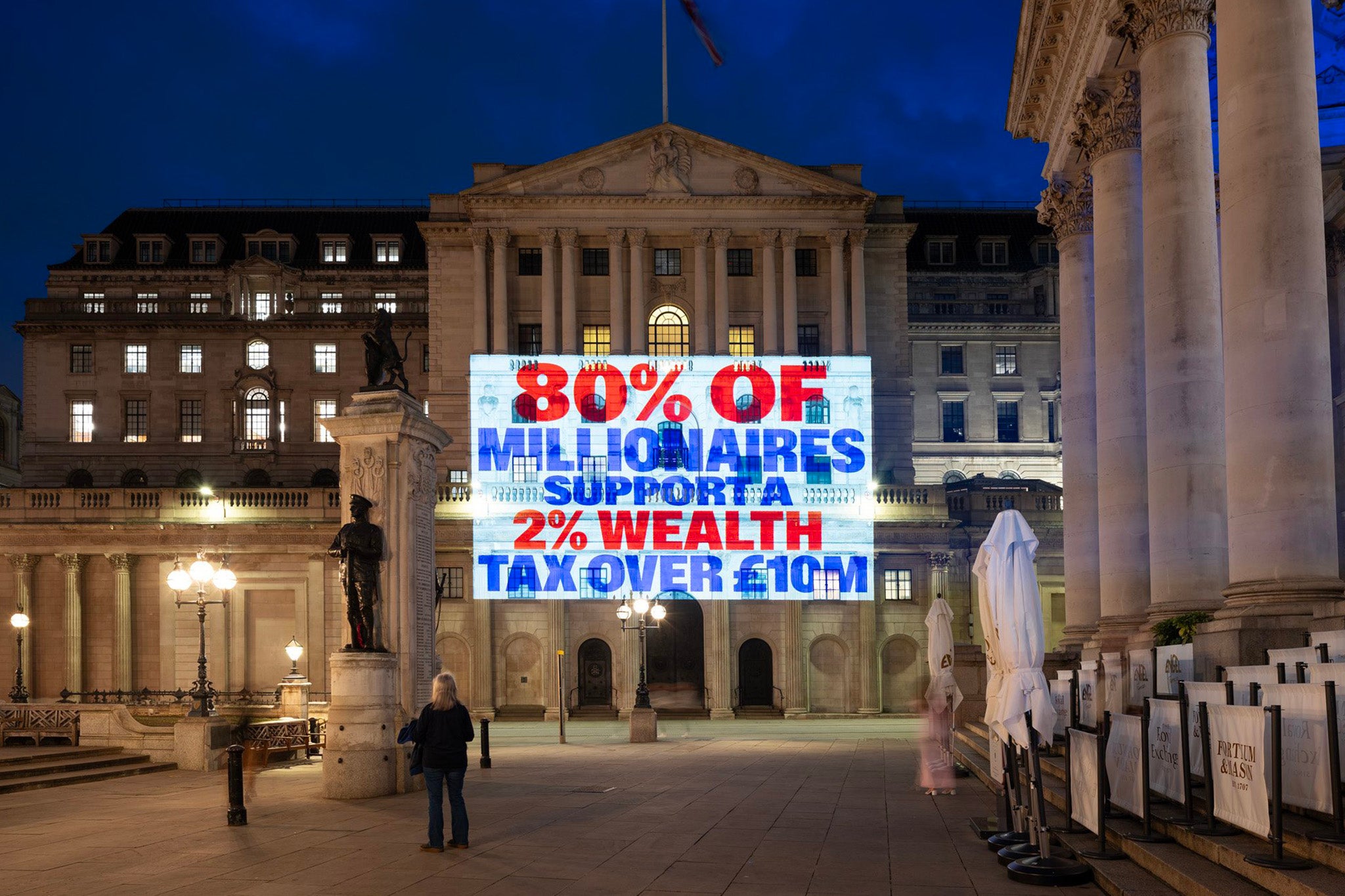

One idea that will not go away is a wealth tax – this would be a tiny tax of 2 per cent on wealth over £10m, affecting a mere 20,000 people or 0.04 per cent of the UK population. It would generate a significant sum to the tune of £24bn a year.

Will millionaires leave the UK if there is a change in tax policy that might have an impact on the richest? As a member of Patriotic Millionaires UK, a group actively asking for higher taxes on extreme wealth and the super-rich, I’ve found this pretty hard to believe. My high net-worth friends and I certainly aren’t going anywhere, and the performative panic over it is frankly hard to take seriously.

Why has there been so much fuss made about less than 0.3 per cent of millionaires projected to leave the country when we’re facing the reality of 30 per cent of doctors considering leaving in the next year? It’s a question we had to have an answer to. So much so that we decided to ask the millionaires of Britain themselves what they thought about wealth and taxes.

Working with Survation, we polled more than 500 of those living in the UK with £1m-plus in investable assets, excluding their homes. What we found was completely contrary to what we’re so often told to be true. Instead of millionaires protesting the notion of higher taxes, there seems to be overwhelming support for them.

The vast majority of millionaires (81 per cent) think it’s patriotic to pay their fair share in taxes; 80 per cent of millionaires polled support a 2 per cent tax above £10m (and for the smaller sample of those with over £10m themselves, this rose to 85 per cent). But it wasn’t just this policy that was popular – across the board, taxes on wealth were overwhelmingly welcomed by the richest people in Britain; three-quarters support increasing the overall effective tax rate on the super-rich.

You may think this is turkeys voting for Christmas, but it’s not. I was fortunate to have a high-paying role for many years as an international lawyer, but like the majority of millionaires who answered our survey, I understand just how harmful concentrated extreme wealth has become.

In the last few months, we have all been forced to face up to the worrying impact of wealth buying power and politics. Eighty-one per cent of my fellow millionaires recognise that extreme wealth buys disproportionate political influence. In an increasingly unstable world, this undermining of democracy is a glaring wound rather than a niggling itch.

In fact, thanks to the first dynamic study of wealth taxes, we now know that the wealth share of those on the Sunday Times Rich List alone would have continued to grow. Even with a 2 per cent wealth tax, the share of wealth owned by tax residents on the list – the top 0.001 per cent – would still have increased from 1.7 per cent to 2.7 per cent.

Millionaires, just like the rest of the population, want a more stable, equal and sustainable economy; we know a fairer, well-oiled and properly resourced country leads to a better life for them and for everyone else too. This isn’t conjecture. We are shown time and again how countries with higher tax rates and better wealth distribution are often some of the happiest in the world.

For the eighth year in a row, Finland has ranked as the world’s happiest country. In Finland, capital gains are taxed at up to 34 per cent, making them far less tax-advantaged than in the UK, where the top rate is just 20-24 per cent.

Unlike the UK, Finland treats capital income more like regular income, reducing the incentive for those holding lots of wealth to shift earnings into capital gains to minimise their tax bill. Other Nordic countries also rank highly in the happiness index. Many of these nations place higher taxes on the richest – something I don’t find surprising. By making sure there is a fairer distribution of wealth, these countries deliver better outcomes for everyone that, as a nation, they can be proud of.

It sometimes feels like we have forgotten how to do this in the UK. We need to feel deservedly proud of our country. For me, what it will take to feel that pride is knowing we are all truly invested in something better and bigger than ourselves as individuals. It might sound “rich” coming from a millionaire, but there are more important things than endlessly increasing personal wealth.

The state of our country is one of them. And I’m not the only millionaire to think this. More than two-thirds of millionaires we polled felt that their success was dependent on Britain’s public services; more than three-quarters supported paying higher taxes themselves to secure a stable, more equal and prosperous country for future generations.

A 2 per cent tax on more than £10m would raise £24bn for the Treasury. That’s enough to service priorities highlighted by the government, such as defence spending (£5bn) and improving transport (£15bn), as well as reverse the cuts to welfare they proposed back in March (£4.8bn). Personally, I’d much rather pay higher taxes so my own children live in a country that is thriving and just, instead of preserving my wealth and worrying more about an increasingly unfair and divided society in which everyone suffers.

.jpeg)

The time is now. With the comprehensive spending review next week, the government must consider not what it should cut, but where it should invest more – young people and future generations deserve the opportunity to buy a house, to thrive whether as employees or entrepreneurs, supported by strong public services and strong digital and national infrastructure.

Vulnerable groups, our veterans and older generations deserve to be cared for well by our country without fear of exclusion and deprivation. Here in the UK, we have the wealth to do this. The evidence shows that most millionaires are proud to pay and here to stay. The chancellor needs to raise taxes on the super-rich – not just because they overwhelmingly support it, but because our country needs it.

Stephen Kinsella, a former EU anti-trust lawyer and member of Patriotic Millionaires UK

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments